From Volatility Drag to Rebalancing Lift: Lessons from Shannon’s Demon

In the early 1960s, Claude Shannon, a Bell Labs engineer and the future “father of information theory,” would flip a single fair coin over and over, re-sizing his wager after each toss. The coin itself had no edge, yet the ledger in his notebook kept climbing – a party trick with profound lessons for portfolio construction.

That thought experiment, later nick-named Shannon’s Demon, delivers a modern lesson: volatility can be both a portfolio’s silent thief and its secret benefactor. Both forces act through the mathematics of compounding, not through headline-grabbing monthly returns. We call the thief volatility drag and the benefactor the rebalancing premium that appears when we mix uncorrelated assets and periodically reset them to target weights. The sections below unpack those two faces of volatility and show how investors can keep the demon on a tight leash while letting it work in their favor.

Volatility Drag: The Hidden Tax on Compounding

Picture we’re driving on a mountain road. We floor the gas on the way up, zooming 30 percent faster than the speed limit. Coming down, we ride the brakes 30 percent below it. The speedometer log says we averaged zero excess speed, yet we burned extra fuel climbing and reached the bottom no sooner.

Markets behave the same way: the simple average can read “break-even” while capital leaks away on the slopes. A stock that rallies 30% on Monday only to fall 30% on Tuesday means this “round-trip” prints a 0% arithmetic average but leaves us poorer, with capital that can no longer earn tomorrow’s returns.

Arithmetic averaging treats gains and losses as if dollars stack linearly; geometric averaging (CAGR) multiplies them, which is how money actually grows or shrinks.

Four two-day paths, all with a 0 percent simple average, yet very different outcomes

| Path | Day 1 | Day 2 | Arithmetic Avg. | End Value | Vol-Drag Loss |

|---|---|---|---|---|---|

| A | +10 % | –10 % | 0 % | $99.00 | –1.0 % |

| B | +20 % | –20 % | 0 % | $96.00 | –4.0 % |

| C | +30 % | –30 % | 0 % | $91.00 | –9.0 % |

| D | +40 % | –40 % | 0 % | $84.00 | –16.0 % |

Every path finishes poorer, and the dent deepens with each extra jolt of volatility. That erosion is volatility drag, a silent tax that compounds against us whenever gains and losses play tug-of-war.

Now flip the example: suppose Monday jumps +10 % but Tuesday only slips -9.5 %. The arithmetic average is actually +0.45%, yet we still end at $99.55. A positive simple average can mask a negative real outcome; proof that the rules of compounding, not the feel-good mean, govern the bottom line.

The takeaway is intuitive but easy to forget: in investing, the journey matters as much as the destination. Big thrills and spills may leave the storytelling richer, but they also leave the wallet thinner unless we have a mechanism to reclaim what volatility drags away.

The chart below turns the thought experiment into a picture. Both lines begin at $100 and cycle through equal numbers of up-and-down moves whose simple averages are identical. Yet the darker, modest-swing path drifts only slightly lower, while the bolder, wild-swing path cascades toward half its starting value. Visually, we can watch volatility drag carve an ever-widening gap between the two trajectories.

Enter Shannon’s Demon: When Volatility Pays the Bills

Volatility’s darker half is the drag we just met; its brighter half is the dividend that Claude Shannon coaxed from pure chance. He began with a riddle: What if we stopped fearing price swings and started farming them? The answer is Shannon’s Demon: a constant-mix rule that turns jitter into jet fuel.

To see the demon in action, begin with a fair coin that pays +50 % if it lands heads and -33.3 % if it lands tails. This is a pay-off pair that keeps the game’s expected value exactly zero (1 + 0.50) × (1 - 0.33)= 1. Flip this coin all day and, on average, we finish exactly where we began.

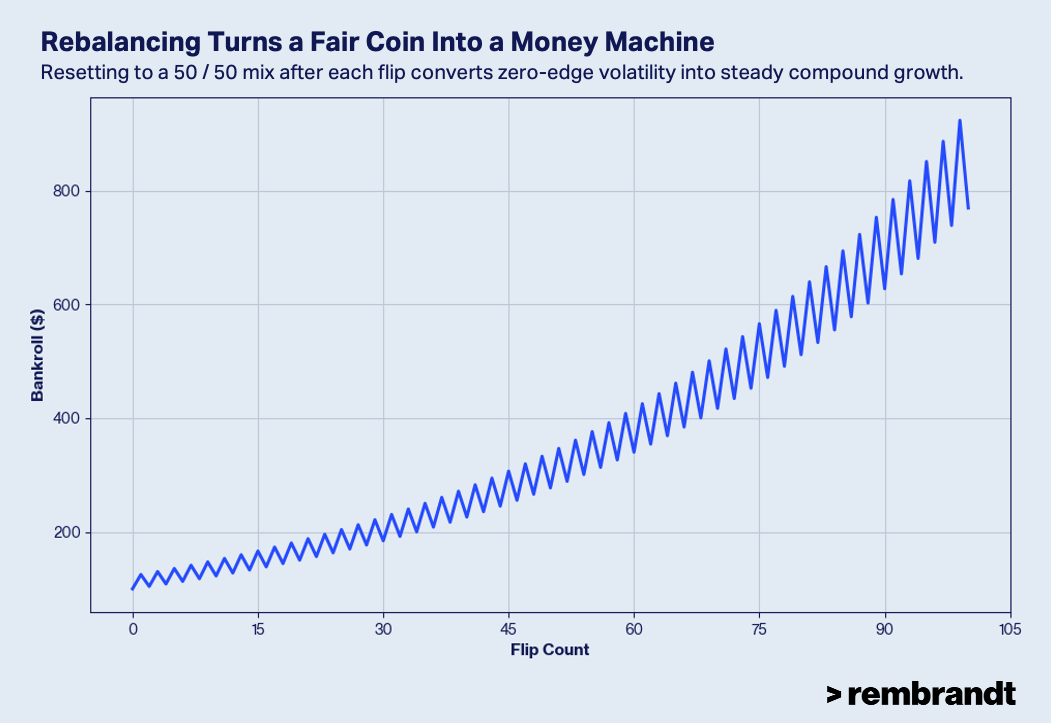

Now if we introduce rebalancing, the magic starts to appear. We split $100: $50 stays in cash, $50 rides on the toss. A head therefore lifts the bankroll to $125 (+25 % overall); a tail taken immediately after trims it to $104.17 (-16.7 %). After every flip we rebalance back to 50/50, selling a slice of what just became “rich” and replenishing what just turned “cheap.” The return does not come from the coin. It comes from the disciplined reset that turns volatility into cash flow.

Play heads-tails-heads-tails and we get a jagged staircase: $100 → $125 → $104 → $130 → … The coin’s expected return is still zero; the portfolio’s trajectory, however, creeps upward because every reset harvests a sliver of spread between the two sleeves. Direction drives buy-and-hold; difference drives constant-mix.

Once we’ve seen the coins grow, portfolios stop looking esoteric. Picture a systematic, quantitatively driven sleeve, one that harvests volatility premia, statistical-arbitrage spreads, and short-term pattern signals, layered over core equity exposure. In calm markets the equity engine provides the familiar beta while the quant sleeve stays mostly neutral; when turbulence hits, model signals flip, positions generate gains, and the regular rebalance shifts capital from the engine that just sprinted ahead to the one that now looks cheap. This is precisely the “two-engine” logic we explored in Return Stacking: one sleeve supplies market beta, the other delivers an uncorrelated alpha stream, yet both ride on the same dollar of capital through collateral-efficient overlays.

The engines don’t have to fire in the same month, or even the same year, to matter; they simply need to take turns, smoothing the ride just as the portable-alpha pioneers envisioned. Weekly or monthly check-ins capture most of the edge, and prudent liquidity buffers stand ready as the modern de-lever triggers we highlighted earlier, scaling Shannon’s compounding magic from coin tosses to real-world, data-driven assets.

Harnessed this way, volatility flips from silent thief to silent partner, funding growth by letting our portfolios’ components take orderly turns at the wheel. In the next section we show why that steady handoff, rather than a sprint for bragging-rights each month, is the real goal of smart diversification.

Why Smoother Returns Win

Our earlier look at diversification and return stacking showed that blending truly independent return streams boosts a portfolio’s Sharpe ratio without asking every sleeve to win on the same scoreboard each month. The new charts make the point visually. The first line graph showed how two paths can post identical simple averages yet end worlds apart once volatility drag does its work. The second graph, built from a heads-tails coin game, revealed how disciplined rebalancing turns zero-edge noise into an upward staircase. Together they underscore the real objective: pursue a steadier trajectory, not a monthly victory lap over the benchmark.

A portfolio of uncorrelated engines delivers that steadiness. When equities surge, the systematic sleeve might idle; when markets convulse, model signals flip, generate gains, and the rebalance shifts capital back to whatever now looks undervalued. Because at least one engine is usually pulling its weight, the whole structure wiggles less and compounds more. That smoother ride matters: investors are human, and the urge to capitulate after a bruising quarter peaks just when future returns are coiling. Staying invested is half the battle in wealth creation, and the simplest way to stay invested is to hold a mix that rarely feels scary.

Shannon’s Demon supplies the math behind that intuition. Let assets take turns, harvest variance through regular resets, and the portfolio keeps humming in all seasons. We may not top the leaderboard every quarter, but our investors arrive farther down the road with fewer white-knuckle moments, durable growth built on the rules of compounding and the discipline to ignore short-term scorekeeping. Our mandate is not to beat the S&P every month; it is to compound client capital at attractive risk-adjusted rates for decades. Shannon’s math shows the road: embrace variance, recycle it, and let discipline drive the journey.